inheritance tax changes budget 2021

While there have been no earth shattering changes to the system of Inheritance Tax in the. Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax.

What Happened To The Expected Year End Estate Tax Changes

Our firm offers many years of experience in estate tax compliance so you can be confident that your clients estate tax returns will be calculated accurately and filed on time every time.

. Looks at changes to corporation tax inheritance tax dividend tax entrepreneurs relief and capital gains tax announced in the 2021 Budget. The speculation is that the current capital gains tax rates of 10 per cent and 20 per cent or 18 per cent and 28 per cent for property will be scrapped and instead everyone. See How to File for more information.

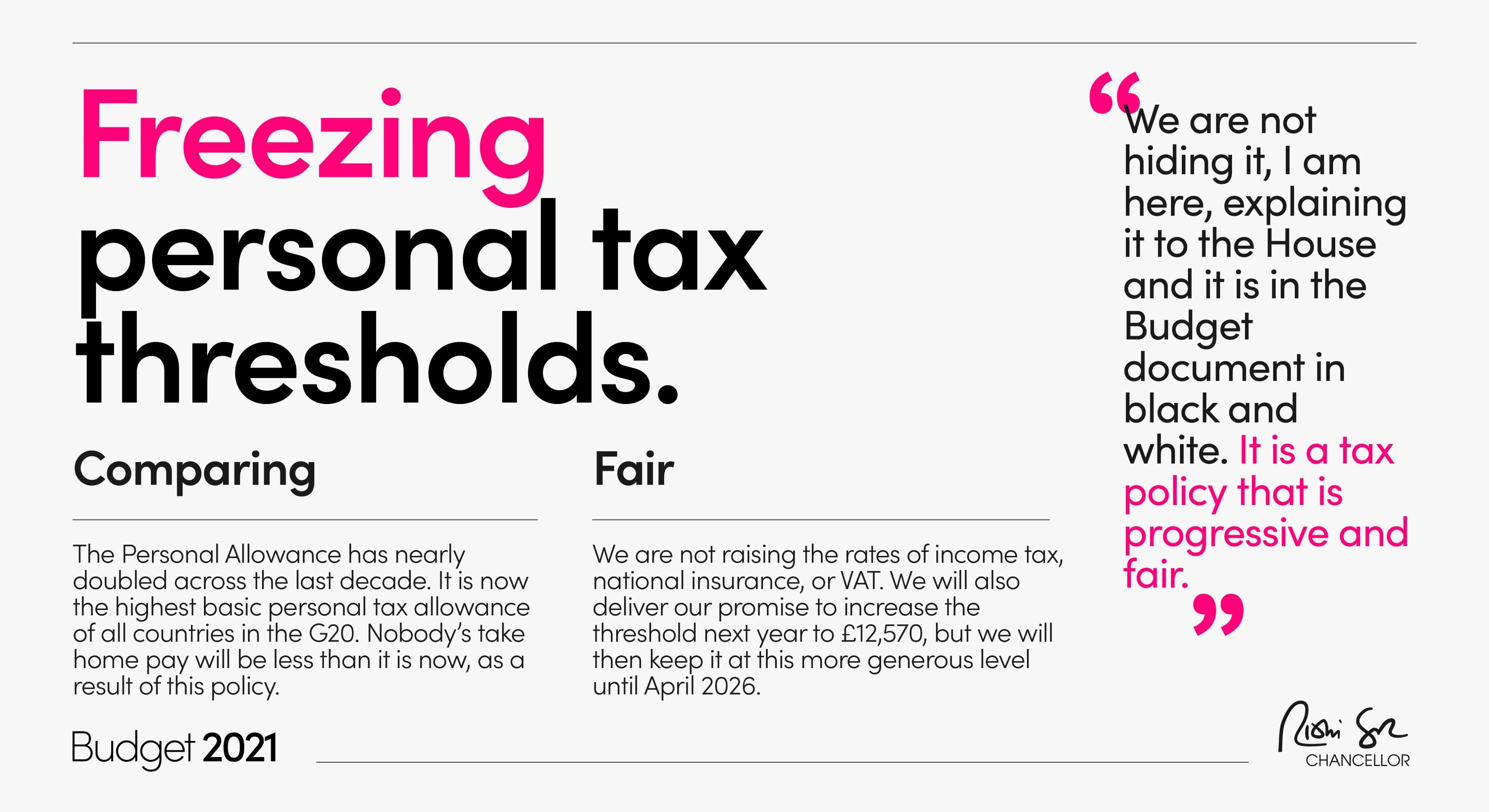

Inheritance Tax changes. Chancellor Rishi Sunak has announced a hike in corporation tax paid on company profits to 25 in 2023 and will freeze a whole host of tax-free allowances in a bid to claw back. April 20 2021 Four is the new big number in Piscataway.

Wahler joins Biden. Lower municipal tax rate for four years in a row. After much speculation in the press that there would be a complete inheritance tax overhaul Rishi Sunak announced in the budget this afternoon that no changes to.

Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate. This evening for four years in a row Mayor. Piscataway Officials Renew Calls For Gun Reform.

The Scheme is extended by one year to 2021 with the government co-funding ratio at 15 and the qualifying gross wage ceiling at 5000. Gross monthly wage increases at least. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds.

Currently there is normally no inheritance to pay if an estate is valued below the 325000 threshold Image. GETTY Camilla Bishop Partner at law. 2021 municipal budget CY.

Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax. In a nutshell everything remains the same. We have begun mailing 2021 Senior.

Chancellor Rishi Sunak walking tax tightrope to balance Budget RISHI SUNAK has announced the Budget for 2021 and Inheritance Tax has. In advance of the Spring Budget on 3 March 2021 there was considerable speculation that the Chancellor would make changes to andor increase rates of inheritance. Following the release of Budget 2022 the 3 main thresholds remain as they were as does the rate of tax payable on any amounts.

With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free. You can still file for the 2021 Senior Freeze. Qualifying estates can continue to pass on up to 500000 and the qualifying estate of a surviving spouse or civil partner can continue to pass on up to 1 million without an.

Inheritance Tax changes. The deadline for 2021 applications is October 31 2022.

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Are Federal Taxes Progressive Tax Policy Center

Changes To Inheritance Tax For Budget 2022 Section72

Uk Budget 2021 Corporate Tax Rise Vat Cut For Hard Hit Sectors Extended Income Tax Thresholds Frozen

Taxes Congressional Budget Office

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

Taxes Congressional Budget Office

/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

There S A Growing Interest In Wealth Taxes On The Super Rich

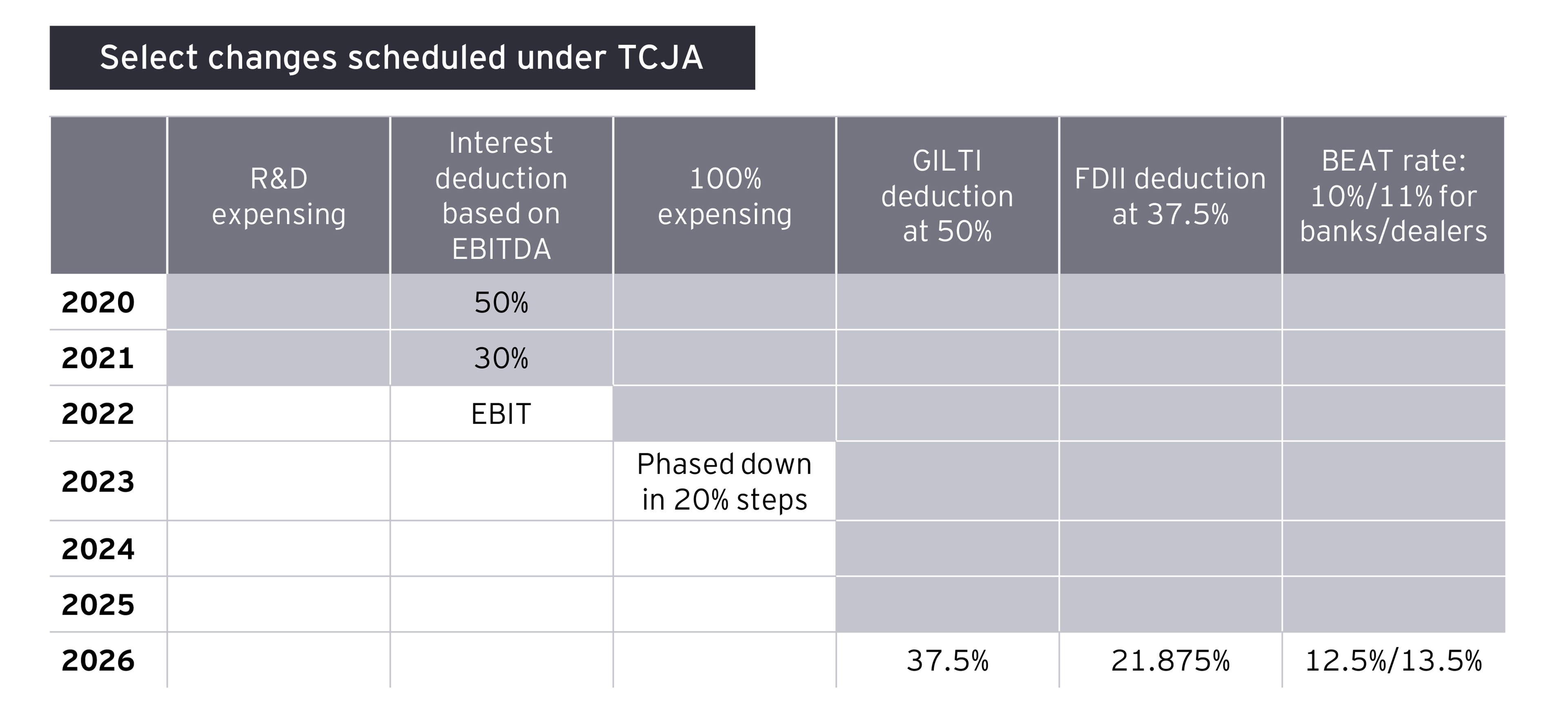

Post 2020 Tax Policy Possibilities Ey Us

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

What Is The Death Tax And How Does It Work Smartasset

Budget 2021 No Change To Inheritance Tax Julie West Solicitors

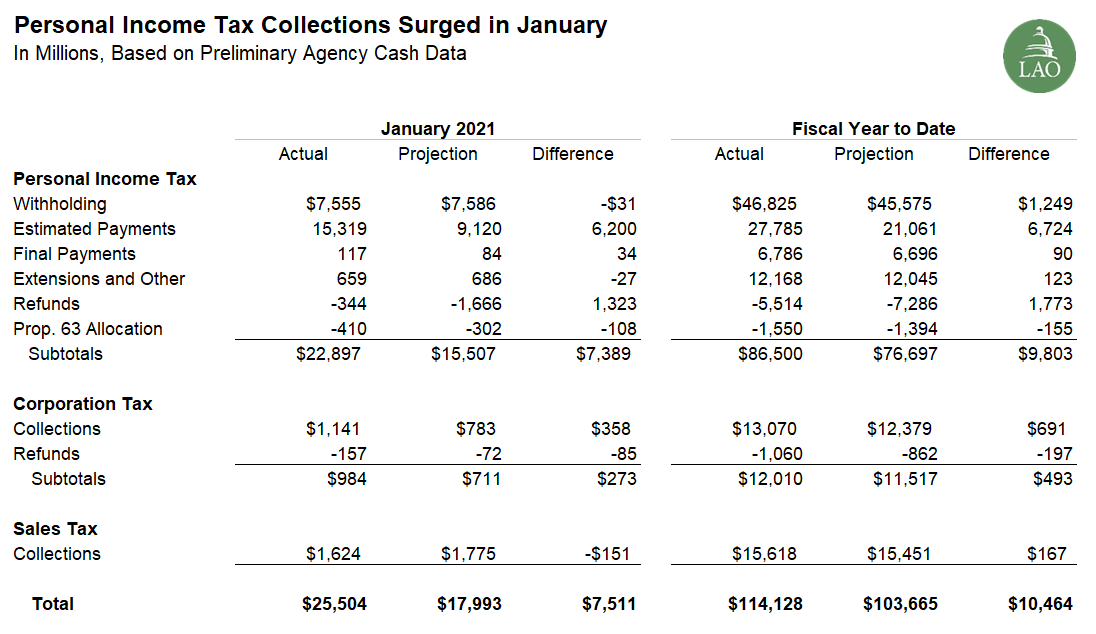

Understanding The Budget Revenues

Key 2021 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

Biden Tax Plan And 2020 Year End Planning Opportunities

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center